If you’ve ever wondered why a single expensive stock can send the Dow Jones Industrial Average swinging, even when the rest of the market seems calm, it all comes down to the way the Dow was built—giving extra influence to higher-priced stocks, rather than the biggest or most important companies. As we walk through how this works, I think you’ll see why so many people who follow the markets closely tend to focus on the S&P 500 instead. Most of us, when we want a quick read on how the US economy did today, look at the S&P 500, since it covers a broad slice of the market. But if you’re interested in what a handful of editors thought was important back in 1896, that’s where the Dow Jones Industrial Average comes in.

To see how the Dow’s quirks play out in real life, think back to early 2025, when the overall market was rising on the back of strong demand for semiconductors and steady consumer spending, yet the Dow suddenly dropped—not because of a big crisis or a flood of bad news, but simply because UnitedHealth Group, which trades at more than $500 a share, took a double-digit hit. Since the Dow gives so much weight to stocks with high prices, that single move was enough to drag the whole index down, even though the other 29 companies were mostly holding steady. This isn’t just a fluke; it’s baked into the way the Dow was designed back in the 1800s, and it hasn’t really changed to keep up with how markets work now. So if you’re trying to get a real sense of what’s happening in the market, the Dow can sometimes send you in the wrong direction, mostly because it’s still around out of habit and tradition.

Let’s walk through why the Dow’s way of measuring things can lead to some odd results, how its selection process leaves out some of the biggest and most important companies, and how a simple experiment shows that a company with a high share price but much less real value can end up overshadowing a true economic powerhouse.

The Committee and The Missing Giants

While the S&P 500 follows a clear set of rules to choose its companies—looking at things like size, trading activity, and profits—the Dow takes a different approach. Instead of using a formula, a small committee simply picks 30 well-known companies, so the list ends up reflecting tradition and personal judgment more than a true cross-section of the market.

One of the biggest issues with the Dow isn’t just about how it measures things, but about which companies are left out entirely.

- Alphabet (Google): One of the most profitable companies in human history, holding a search monopoly. Absent.

- Meta Platforms: The social media utility used by half the planet. Absent.

- Berkshire Hathaway: The ultimate American conglomerate. Absent.

- Broadcom & Tesla: Critical infrastructure and automotive leaders. Absent.

So why are these giants missing? The official answer usually talks about keeping a balance between different industries, but the real reason is that the Dow just can’t handle companies with really high share prices. The Dow simply isn’t set up to handle companies whose shares trade at really high prices. If a stock is priced at $1,000, it would completely dominate the index, making the other 29 companies almost irrelevant. So the committee has to leave out companies that don’t split their shares or that just have a high price per share, which means the Dow ends up favoring companies that keep their share price in a certain range, rather than the ones that actually create the most value.

You can really see these quirks in action if you look at what happened in November 2024, when Nvidia finally replaced Intel in the Dow. Intel had stayed in the index for years, even though it wasn’t growing much, mostly because that’s just how things had always been done. Meanwhile, Nvidia was already driving the S&P 500 higher long before the Dow committee made the switch. Because the Dow reacts so slowly, it often misses out on the best part of a company’s growth. By the time a fast-growing company splits its stock enough to get included, the most exciting gains have usually already happened, so the Dow ends up adding companies after they’ve peaked, while the S&P 500 gets in much earlier.

Right now, you can find odd situations where a company like Travelers, which is a solid insurance business but not nearly as important as the biggest tech firms, can have just as much influence on the Dow as Apple, simply because their share prices are close. So instead of really reflecting the market, the Dow ends up acting more like a random collection of stocks shaped by quirks in share price.

The Optical Giant

To see why this can be a problem, it’s worth looking at the math. The Dow is calculated by adding up the prices of the 30 stocks and dividing by the “Dow Divisor” (which is currently about 0.15).

This means a 10% move in a $500 stock has 10 times the impact of a 10% move in a $50 stock, even if the $50 stock is a company 50 times larger.

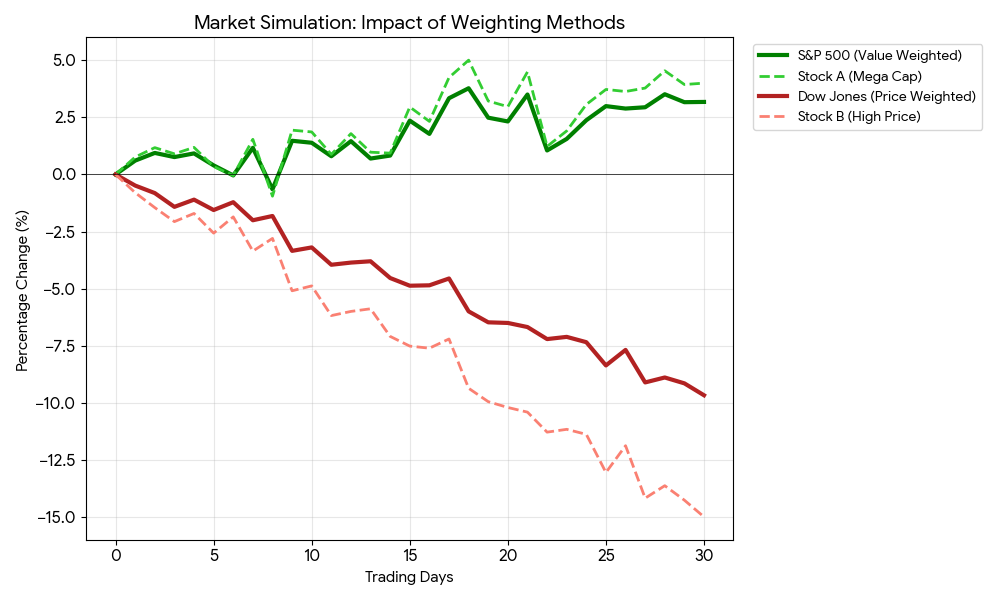

To show how this plays out, I put together a simple simulation of a 30-day trading month with two companies: Stock A, a mega-cap giant (like Apple) with a lower share price, and Stock B, a high-priced company (like Goldman Sachs) with a smaller market cap. In this setup, the big, fast-growing Stock A climbed 4% and added a lot of value, while the high-priced Stock B lost significant ground. You can see the results of this simulation in the figure below, which compares the S&P 500 (value-weighted) and a Dow Jones-style (price-weighted) index.

So what happens? If you measure the market the way the S&P 500 does, you see a healthy gain of about 3.2 percent, which reflects the real value created by the big growth company. But if you use the Dow’s method, the index actually drops by nearly 10 percent, just because the high-priced stock went down. Instead of a small error, you end up with a result that’s completely backwards from what’s really happening. This little experiment shows how the Dow lets the sticker price of a share—which is really just a number set by company management—outweigh the real money that investors have put into the business.

Takeaways

The Dow Jones Industrial Average is really just a holdover from a time when it was too hard to calculate a more accurate index by hand. These days, it doesn’t tell us much about the economy; it just tracks the average share price of 30 companies that were picked for reasons that don’t always make sense anymore. If you’re a casual investor, following the Dow probably won’t hurt you, but if you’re someone who really wants to understand the market using the Dow can send you off course, since it brings in random swings that don’t actually reflect real risks or opportunities. People who want to get the real story look to the S&P 500 for the big picture and dig into the details for extra insight, while the Dow is mostly something we keep around for nostalgia.

References

- S&P Dow Jones Indices. “Dow Jones Industrial Average Methodology.”

- Siegel, Jeremy J. Stocks for the Long Run. McGraw Hill, 2022.

- Standard & Poor’s. “S&P 500 Methodology.”

- The Wall Street Journal. Market Data Center.

Disclaimer

- This content is based solely on publicly available information.This content is for educational and entertainment purposes only. The author is not a financial advisor, and the content within does not constitute financial advice. All investment strategies and financial decisions involve risk. Readers should conduct their own research or consult a certified financial professional before making any financial decisions.

- The opinions expressed in this article are my own and do not represent the views of Google.

Leave a Reply