Most people in personal finance will tell you to just buy the S&P 500 and relax, since it is the go-to choice for 401(k)s, the measuring stick for fund managers, and the comfort zone for anyone who wants to play it safe. But if you like to dig into the numbers the way an engineer might, you might spot something odd in that advice. Since January 2007, which covers some wild times like the financial crisis, the COVID crash, and the inflation spike in 2022, the S&P 500 (SPY) has gone up by a hefty 585%.

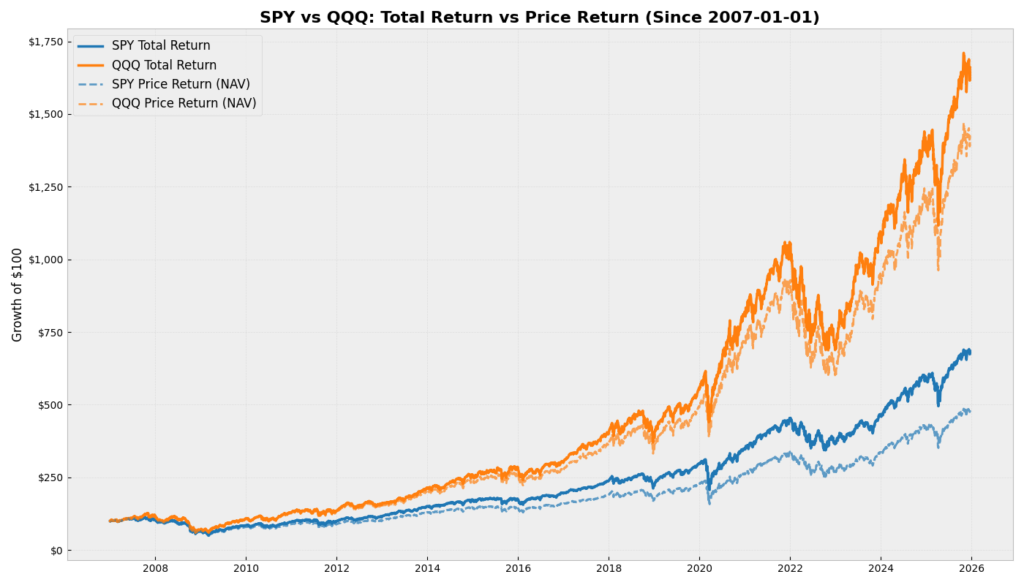

But the Nasdaq 100 (QQQ) has done something even more dramatic, climbing 1,560% in the same stretch as you can see in below figure. That is not just a small difference—it is like tripling your net worth compared to the S&P 500. To put it in real numbers, if you had put $10,000 into the S&P 500 back in 2007, you would have about $68,000 now, but if you had chosen the Nasdaq 100 instead, you would be looking at almost $166,000. That kind of gap makes me want to dig deeper and figure out what is really going on. Is the Nasdaq 100 just taking on way more risk, or is there something else at play? To get some answers, I pulled the raw data for both SPY and QQQ since 2007, looking at total returns, volatility, and the worst drops along the way. Let’s see what the numbers actually tell us.

Whenever we compare two different systems, we usually want to know how much we are getting out for what we are putting in, and in finance, that often means looking at the Sharpe Ratio, which is just a fancy way of saying ‘return for each unit of risk.’ When I ran the numbers from 2007 to 2025, I found that the S&P 500 grew at about 10.7% per year with 19.8% annual volatility, while the Nasdaq 100 grew at 16% per year with 22.3% volatility. The big takeaway here is that the Nasdaq 100 gave you about 50% more return each year, but only asked you to take on about 12% more volatility.

The “risk” argument is often overstated. While the Nasdaq is indeed more volatile, it hasn’t been proportionate to its outperformance. In fact, during the 2008 Financial Crisis, the max drawdown for both indices in this window was surprisingly similar (around -53% to -55%). The S&P 500 wasn’t a magically safe bunker; it fell just as hard because it was weighted down by failing financials (banks), while the Nasdaq was hit by tech valuation compression. Something that really stood out to me in the data is how much dividends matter. People often give the S&P 500 credit for its steady yield, and if you compare just the price return (which ignores dividends) to the total return (which includes reinvested dividends), you can see there is a huge difference for SPY.

- SPY Price Return: 381%

- SPY Total Return: 585%

So more than half of the S&P 500’s growth actually came from dividends being paid out and then put back to work. Now look at the Nasdaq 100:

- QQQ Price Return: 1,327%

- QQQ Total Return: 1,560%

For the Nasdaq, dividends are a nice bonus, but the engine of wealth accumulation is pure, unadulterated capital appreciation (Net Asset Value growth). For younger investors in the accumulation phase, relying on the S&P 500 means relying heavily on dividend reinvestment to keep up. The Nasdaq 100, by contrast, forces companies to reinvest that capital internally into R&D and growth before it ever hits your brokerage account. From a tax efficiency standpoint (in a taxable account), the Nasdaq’s approach is superior. You pay taxes on dividends every year. You only pay taxes on capital gains when you sell. The Nasdaq 100 is essentially a tax-deferred compounding machine.

So why do these two indexes behave so differently? It really comes down to what each one actually owns, because the S&P 500 is still very much tied to the old guard of the economy—think energy companies, banks, utilities, and the kinds of businesses that make up our daily essentials. These sectors tend to balance each other out, since when oil prices go up, airlines usually take a hit, and when interest rates rise, banks might benefit while real estate struggles, so the whole thing ends up being a bit of a hedged bet. The Nasdaq 100, on the other hand, is almost a pure play on innovation, since it leaves out financials entirely and puts most of its weight behind technology and consumer companies. If you look at what’s happened since 2007, we’ve really shifted from an economy built on physical things—like oil and manufacturing—to one built on digital platforms, with companies like Apple, Microsoft, and Nvidia capturing more and more of the value. The S&P 500 does include these tech giants, but their impact gets watered down by hundreds of slower-growing companies, while the Nasdaq 100 just puts you right in the middle of where the growth is happening.

If you’re 55 and starting to think about retirement, it makes a lot of sense to lean toward the S&P 500, since its steadier returns and higher yield can help you protect what you’ve built. But if you’re younger—say, in your twenties or thirties—the numbers tell a different story, because what looks like the safer choice might actually be costing you a huge amount in missed growth over the long run. The difference in volatility between these two indexes is pretty small when you stretch it out over twenty years, but the gap in returns is massive, and that can completely change your financial future. Personally, when I think about the core of my own investments, I see the Nasdaq 100 less as a risky bet on a single sector and more as a snapshot of where the real growth in the economy is happening right now. The old-school companies aren’t disappearing, but they’re not where the big leaps are coming from anymore.

References

[1] Yahoo Finance. “S&P 500 (SPY) and Nasdaq 100 (QQQ) Historical Data.” Retrieved Dec 2025.

[2] Nasdaq.com. “Nasdaq-100 vs. S&P 500 Performance.”

[3] Slickcharts. “S&P 500 vs Nasdaq 100 Sector Weightings.”

Disclaimer

- This content is based solely on publicly available information.This content is for educational and entertainment purposes only. The author is not a financial advisor, and the content within does not constitute financial advice. All investment strategies and financial decisions involve risk. Readers should conduct their own research or consult a certified financial professional before making any financial decisions.

- The opinions expressed in this article are my own and do not represent the views of Google.

Leave a Reply